Payroll management is a critical aspect of any organization’s operations, and ensuring accuracy, efficiency, and compliance is essential. Workday, a leading cloud-based human capital management (HCM) system, offers a robust platform for managing various HR functions, including payroll. With Workday’s third-party payroll integrations, organizations can streamline their payroll processes, automate data transfer, and achieve greater efficiency. In this blog post, we will explore the benefits and capabilities of Workday third-party payroll integrations and how they can revolutionize your organization’s payroll management.

Workday offers a range of Payroll Integration products . Payroll Interface is a packaged integration template with a configurable set of HCM data across a range of categories. Most commonly used payroll interfaces are PICOF ( Payroll Interface Connector output Format) and PECI ( Payroll Effective Change Interface) . When launched, the integration captures changes to employee data for a given pay group and pay period. While some vendors prefer to have PECI , some prefer to have PICOF. Let me explain the main and the primary difference.

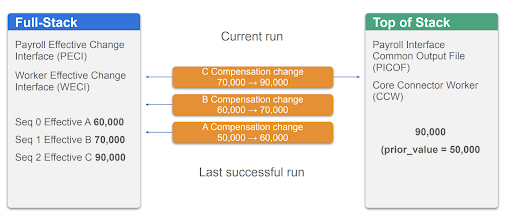

PECI supports a sequence of effective dated changes while PICOF supports only top of stack single change with an effective date. Let me explain you with an example :

Take a scenario where an Employee had been given a merit increase in three trenches as shown below in Orange , PICOF would only pick up the latest value of 90000 and send it to the vendor while PECI would pick up all three changes as separate transactions .

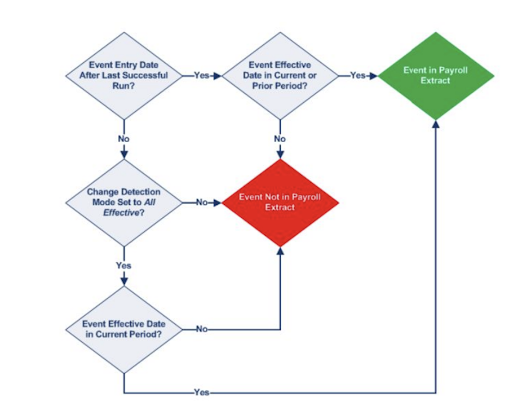

You might have observed the terms Last successful run and the current run , in the picture above . These terms are the most relevant when we talk about change detection in workday. All integrations that detect changes work primarily on these two parameters. If we dig deep into how the payroll interfaces detect changes , here is a simple flow diagram to explain how a change entered in Workday would be extracted by the payroll interface.

Advantages of Payroll interfaces with examples

1. Seamless Data Integration: Workday’s third-party payroll integrations enable seamless data integration between Workday and external payroll systems. By connecting with popular payroll providers such as ADP, Paychex, or Ceridian, organizations can eliminate manual data entry, reduce errors, and save valuable time. The integrations ensure that employee information, tax details, salary changes, deductions, and other payroll-related data are automatically synchronized between systems. This streamlines the payroll process and minimizes the risk of data discrepancies. There is a flavor of these payroll integrations called GPC ( Plobal payroll Cloud) built on the technology of PICOF, PECI which a consultant should always keep in mind when choosing the best implementation methodology. These GPC integrations are built by Workday in close collaboration with the Vendor keeping in mind the country specific local regulations. Now That makes the integration seamless and hassle free. Some of these include ADP’s Global View , NGA HRExchange etc.

An implementation consultant shall follow this order when designing a payroll interface. The order of precedence would be GPC Integration > PECI > PICOF .

2. Accuracy and Compliance: Accurate and compliant payroll processing is crucial to maintain employee trust and meet legal obligations. With Workday’s third-party payroll integrations, organizations can leverage the robust features and capabilities of both platforms to ensure accurate payroll calculations, tax deductions, and statutory compliance. The integrations enable the exchange of information related to employee hours, earnings, deductions, and tax withholding, ensuring accurate payroll calculations and timely delivery of paychecks. Additionally, the integrations facilitate compliance with federal, state, and local payroll regulations, reducing the risk of penalties and legal complications.

While we talk about compliance , some countries require hours to be paid one month in retro . These hours can be On-call additional hours. These interfaces also support this by linking time periods and help in staying compliant .

3. Enhanced Efficiency and Time Savings: Manual payroll processes can be time-consuming and prone to errors. Workday’s third-party payroll integrations automate key payroll tasks, improving overall efficiency and saving valuable time for HR and payroll professionals. By eliminating the need for manual data entry and reconciliation, organizations can reallocate their resources to more strategic activities. The integrations also enable faster processing of payroll, ensuring that employees receive their payments promptly. This not only enhances employee satisfaction but also minimizes payroll-related queries and disputes.

Workday offers a wide range of products together with the payroll interfaces making it easier for organizations to synchronize Employee data with their payroll systems. One such enhancement is Event Driven Integration ( EDI). This normally comes together with the above mentioned GPC integrations. Event Driven Integrations as the name suggests export data to the payroll vendor almost immediately after the transaction is completed in Workday. This is more efficient than exporting data in daily or weekly scheduled batch runs there by saving enormous amounts of time.

4. Centralized Reporting and Analytics: Workday’s third-party payroll integrations provide organizations with centralized reporting and analytics capabilities, empowering them to gain valuable insights into their payroll data. By consolidating data from Workday and the integrated payroll systems, organizations can generate comprehensive reports on payroll costs, tax liabilities, employee earnings, and more. These insights help organizations make data-driven decisions, identify cost-saving opportunities, and proactively manage payroll-related risks. By leveraging the power of analytics, organizations can gain a deeper understanding of their workforce and make informed decisions to optimize their payroll processes.

Let us dive a bit deeper into the reporting capabilities . There are interfacing capabilities with the payroll vendor to bring back payroll results back into Workday. Import Payroll Results is a template which the consultant could use to bring back Payroll results from the Vendor.Now you might argue why would someone do that and that is where Workday’s reporting capabilities together with PRISM come into the picture. You can create dashboards or use workday’s PayHub to provide employees and HR Advisory teams with various insights. A simple example would be a dashboard for the HR/payroll team to slice data on the spend expenditure for car/commuting allowance etc.

5. Scalability and Flexibility: Workday’s third-party payroll integrations offer scalability and flexibility, allowing organizations to adapt to changing business needs and accommodate growth. As organizations expand or acquire new entities, integrating their payroll systems with Workday ensures a seamless transition and consistent payroll management across the entire organization. The integrations can handle complex payroll structures, diverse pay groups, and multi-country payroll requirements. This flexibility enables organizations to scale their payroll operations without disruption, ensuring a smooth experience for both HR teams and employees.

It is also important to note that these integrations ( PICOF , PECI ) can be combined with other integration technologies and methodologies like Workday studio to enhance the flexibility. Not all payroll providers have a GPC Connector as discussed above and that is where studio can be used on top of a PICOF or a PECI to transform the extracts into vendor specific formats.

Payslips and local Payroll Data

Workday payroll integration package also allows organizations to bring payslips that are generated at the vendor back into Workday . This gives employees a seamless experience of being able to see the payslip in Workday rather than logging into the payroll vendor’s website. Almost 95% of the organizations prefer to do this unless there is a very strong reason for payslips to be hosted by the vendor.This functionality is not just limited to Payslips but can also be extended to import Year End tax statements into Workday to have everything at one place.

Certified payroll Integrations with Vendors also enable organizations to open the user interface for employees to be able to enter localized payroll data in Workday. This data is then automatically integrated to the vendor through APIs behind the scenes. Localized payroll data can be anything local legislation related , tax related or even company specific deductions.

Recommendations

PECI integrations run on a grid. Grid is a shared resource in your Workday tenant. If you’re scheduling multiple integrations on grid, Workday recommends that you stagger your integration schedule.

When scheduling multiple integrations to run in parallel, consider:

- Job size, or number of workers you process in an integration. For PECI integrations, consider the number of workers in the pay group you process.

- The number of integrations you run at the same time. Example: If the maximum size of your pay group is 5,000 workers, you can run 4 integrations in parallel. If the maximum size of your pay group is 12,000 workers, you can run 2 integrations in parallel.

Integrations that process 12,000 or more workers require additional considerations. Workday recommends that you set pay period intervals no longer than monthly for normal payroll processing in order to avoid impacting processing time.

Conclusion

Workday’s third-party payroll integrations offer organizations a comprehensive solution to streamline their payroll processes, improve accuracy, and enhance efficiency. By seamlessly integrating with external payroll systems, Workday enables automatic data synchronization, eliminates manual entry, and ensures compliance with payroll regulations. The integrations empower organizations to leverage centralized reporting and analytics, enabling data-driven decision-making and strategic workforce management. With scalability and flexibility, organizations can adapt their payroll processes to meet evolving business needs. By embracing Workday’s third-party payroll integrations, organizations can transform their payroll management and create a more efficient and compliant payroll environment.